Dollar Cost Average (DCA) Investing in Cryptocurrencies

Cryptocurrencies are an exciting and volatile market to invest in. There are some phenomenal returns to be had, and also some phenomenal losses.

But one approach that has shown over time to be a much lower risk to investing is Dollar Cost Averaging. With DCA you pick a specific fixed amount of cash to invest each day/week/month and invest regularly. No matter the price. The idea is that if the price is high, then you end up buying less of the asset, but when low you buy more. By buying a smaller amount regularly, you spread the risk, and it can become something that you can 'forget about'.

I set about actually calculating how well DCA can work, with just investing a small amount regularly.

Let's take an example. I (used to) buy a coffee every morning on my way to the office, pre-covid. Let's say that coffee cost me $2. Some would say that is a low price, but I'm going to pretend I do this 7 days a week, not 5. The point is not the exact figure, but more that it is what I would consider “a small amount”. Everyone is different, and I'm aware that spending $2 a day on a coffee is a luxuary to many people. Adjust accordingly. I could live without that coffee each morning and make my own, or just have one less coffee per day etc. Maybe you are a smoker and you give up smoking. Or a drinker and you have one less beer.

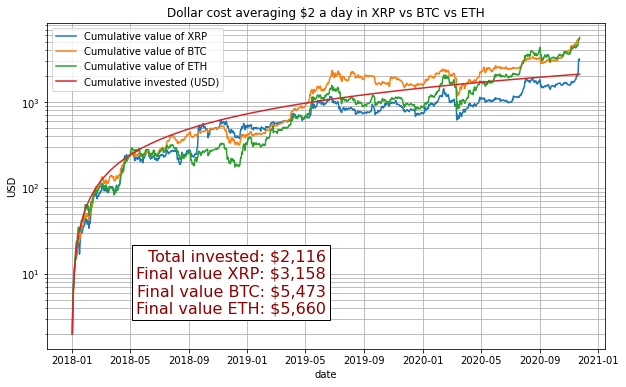

What would happen if I invested $2 in buying XRP, ETH or BTC every day for the past 4 years?

This is a chart of the cumulative value of that investment. It is plotted on a logarithmic y-axis so as easier to see the lines when they peak. But the main point here is that in that 4 years, I would have invested a total of $2,922 and yet, if invested in XRP, would be worth just over $23K.

That is the price of my campervan. That I bought 2 years ago. I could have drunk one less coffee and in 4 years had enough to buy my campervan.

The interesting thing to note, is apart from a few days right near the start, the investment was always worth more than what you put in.

But why 4 years? Well, the Bitcoin halvening time is 4 years, and so much of the cryptocurrency market moves in cycles of around that duration. The idea was to capture both a bull and a bear market.

But what I you started at the all time high in Jan 2018? Well, let's see:

Clearly, the result is not as good as before, but it is still positive at the end! OK, so XRP only just made it in the last week. But, still, this is only half a market cycle. Whilst your investment would have been underwater for much of that time, in the end you would have still done well.

But, investing daily might seem a chore. Unless you can automate it, no-one is going to do that. But what about weekly or monthly?

So investing roughly the same actual amount $14 a week, or $60 a month over the same time period and you'd have still done pretty well. Not quite as well as daily, and I think that is because that captures some of the flash drops, and also doesn't capture the rise XRP has had in the past few days.

But still good!

How about a combination to spread the risk? How about if you invest $7 a week in each of XRP, BTC an ETH. So an equivalent of $1 a day in each of the top 3 cryptocurrencies:

I switched this chart to a linear scale, as viewing stacked areas on a log scale made it hard to see the contribution each currency made. But again, you can see our total investment is always well above the amount we have put in. By the end (not including this week's surge in price) our investment is over 5x what we put in.

How else can you DCA? Well... I think of the micropayments I receive from Coil and Cinnamon as my own small DCA. Every day I receive a small amount of XRP that is just slowly accumulating in a wallet. Maybe it will be buying me a new campervan in 4 years time? ;)

As always, no-one can predict the future, prices may go up as well as down. Only invest what you can afford to lose. But hopefully this shows one particular way you can slowly invest over a period of time and spread the risk.

Take care!

-Matt