Who stole Greta Thunberg’s childhood?

First, let’s start in order! I am for world peace, and I am for the ecology! Civilization has accumulated environmental problems, and they undoubtedly must be resolved in the near future ASAP. No one argues with that! Again, the tools with which a certain part of the global liberal-democratic power, through the hands of the Greens, is trying to influence public opinion cause doubts and dislikes. Despite all the cries for equal rights, ecology, equal chances, gender and juvenile rights, liberal institutions began to exploit the fragile psyche of kids. Yes, today we will talk about Greta Thunberg!

All the world media is talking about her now. However, we will consider the phenomenon of Greta both from the side of utility and harm. Someone say the following: this is a Swedish schoolgirl with a strong civic position, who has become famous for her stupid and heart-rending actions about an environmental disaster, and has become a role model for a dumb young liberals in many countries of the world. Others say: smart, well done, better youth, fighter, she has her political future.

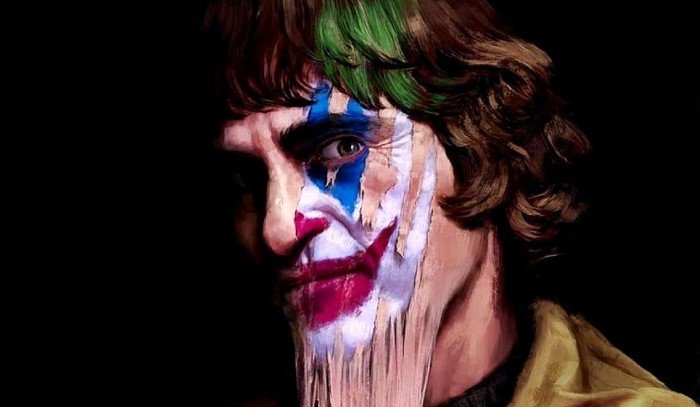

What did we see on the cover?

Little Greta, who suffered, in her own words, from anorexia and depression (she also, according to the media, was diagnosed with Asperger syndrome, which can be considered the easiest form of autism), suddenly in 2018 realized that the world would soon die from global warming, and to prevent this, she stopped going to school on Fridays. After that, the brave girl Greta became a world hero, crossed the Atlantic under sail and spoke on the UN platform recently in September 2019. After Greta’s speech, the leftists of the whole world shuddered in a single ecstasy of admiration. The Guardian compared Greta to Abraham Lincoln! This too active behavior of left and left-wing radical activists, partially revealing the nature of the phenomenon of the girl Greta. A teenage girl suddenly became the face of the global youth green movement and was nominated for the Nobel Peace Prize. In a sensitive yellow (left-wing radicals color) jacket and with a large poster, she went out day after day to the building of the Swedish parliament. The young activist was noticed, Facebook marked her profile with a blue checkmark of a famous person (and we know that Facebook suffers from left-wing radical views and values). Then came an invitation to speak in Davos (another world meet up of wealthy left oligarchs from around the world), and now, hundreds and thousands of followers around her … World media report that 1.5 million schoolchildren from 125 countries took part in protests against climate change instead of going to school. Great story isn’t? No, this is, first, an excellent performance, the liberal world troublemaker Soros paid for the production of which.

First, the Swedish press writes that Greta is not at all a simple girl from the street. She is from a well-known artistic family in Sweden: her father is an actor, her mother is an opera singer, who represented Sweden at the Eurovision Song Contest in 2009, and her grandfather and grandmother are actors and directors as well. After all, adequate people understand that education in such a family is not quite simple, and such people perfectly understand how to tell their daughter how to promote herself properly. No one believes in the agenda that her parents did not support her and Greta herself, through denial, gradually began to attract them to her public green activity systematically. I do not believe that, having noticed the first signs of success; adults did not help her with at least professional advice.

The fact is that shortly before the start of “Fridays for Future”, Greta’s parents released the book “Scenes from the Heart”, which tells how mental disorders of children made them think about the health of the planet. What a lovely coincidence! The version may seem quite plausible that in the case of Greta Thunberg we get endless arguments that the Swedish schoolgirl is an unhappy puppet in the hands of the world behind the scenes, her parents, “leftists” and many others as well. Nevertheless, such a version has the right to be real. The quick success and instantly untwisted worldwide popularity give reason to think about it. What is already hysteria around her name today? The worship of Greta takes on a religious character. “Greta Thunberg is the prophet of our time! .. She is completely comparable to the biblical prophets”, says the Swedish Social Democrat and radical feminist Anna Ardin (who was allegedly raped by Julian Assange?). The girl’s mother gives her daughter supernatural abilities; EurAsia Daily quoted her as: “Greta belongs to the small number of people who can see carbon dioxide with the naked eye. She saw how greenhouse gases flow from our chimneys, soar, rising upwind, and transform the atmosphere into a giant invisible landfill”. In this case, if you are an adequate person, you need to treat the mother rather than the daughter. It got to the point that the Lutheran church in the Limhamn district of the Swedish city of Malmö declared: “Jesus chose Greta Thunberg as his successor”. Deputies of the Swedish Riksdag from the Left Party and deputies of the Norwegian Storting from the Socialist Left Party (both structures unite eco-socialists, neo-Marxists, LGBT activists and radical feminists) nominated Greta Thunberg for the Nobel Peace Prize.

All these facts indicate that “Greta Thunberg” is a project!!! The initial PR managers were left-wing Scandinavian globalists.

For some time, the project was supervised by Swedish PR man and businessman Ingmar Rentzhog (who did not fail to use her name to attract millions of dollars to his environmental startup We Don’t Have Time) (https://www.wedonthavetime.org) and the owner of Stockholm PR offices of Iles PR Helena Iles (by the way, an old friend of the girl’s mother). The Swedish newspaper Svenska Dagbladet wrote about this last year. Since the winter of 2018, serious supranational structures like the Club of Rome have already started promoting the project (on March 14, 2019, it issued a special statement in support of Greta). The direct management is carried out by the Soros Foundation and the Marshall Global Plan organization (headed by former US vice president Al Gore, George Soros looms among the main figures), whose experienced representatives formed the “coaching staff” at Thunberg, inspire and indicate the right direction, create texts, provide protection, cut off unwanted people. In many photos and videos next to Greta, you can see the young German political scientist Louise-Maria Neubauer, who is functionary for the Bill and Melinda Gates’s ONE Foundation and Soros Open Society global fund. Such a funny left-wing radical campaign seeks Greta’s innocuous actions on Instagram with the hashtag #Fridaysforfuture over time to turn into a dictatorship of young environmental hunveibins.

What is Greta fighting for? Most likely, Greta’s intention (if she has one at all) is to arouse concern in people, especially politicians, about climate change and to give the problem the widest possible publicity. Greta plans to go on strike until the governments of the leading countries of the world (including Sweden) take the necessary measures to ensure that the average temperature increase on the planet is within 2 ° C. Greta did not take these figures from the ceiling — these requirements were developed by scientists for the Paris climate agreement in 2015, and they are quite real. To achieve such a result, Thunberg proposes a 15% reduction in carbon dioxide emissions, as prescribed by the agreement. Well, who is interested in implementing such agreements?

Our ubiquitous Transnational companies, which supposedly fulfilling such a framework of the agreement, will be able to prevent the developing economies of the world from stepping on their tail, effectively hampering their economic development, while they themselves can calmly, without competitors and preserving their corporate income, receive benefits and profits, even at such rates of moderate decline in development. Therefore, Greta in the eyes of understanding people has become the logo of ‘’Ecology as a business’’. What kind of result can be? Climatic problems will still be there and the same, no any new recipes for their solution have been proposed yet, especially since Greta is not capable of them. Trump did not believe in global warming, but believed in the revenue side of the budget. Students skip classes for Fridays. Greta received that very blue checkmark on Facebook and, no doubt, will begin a political career soon. The Nobel Peace Prize continues to lose its significance and turns into a libertarian farce.

Well, what about Greta? Is child exploitation for political games ethical?

The world has rarely seen such a meaningless and so infantile speech from an unbalanced teenager, whose mind was torn off from her triumph. What can I say … All totalitarian ideologies are happy to exploit this feature of the psyche of a teenager — a desperate desire to establish itself at the expense of adults, combined with suggestibility and infantilism. Let the teenagers turn over this order of things so hated by them. Let them not go to classes! Let the children with a weak mentality teach teachers, beat teachers, and humiliate professors. Look carefully at Greta’s speech at the UN in September 2019, look at her intonation, facial expressions, gestures, tone of phrases. After all, everything is saturated with hatred, anger and annihilation, and not kindness, pacification, and appeal. After such a speech, the green movement and ecology will very quickly become synonymous with terror, radicalism and destruction. In this way, environmental issues cannot be resolved and attention cannot be drawn to them; on the contrary, they can scare, reject, and omit the importance of the issue. Ecology remained in its place, but Greta divert attention from ecology to the side. Indeed, the issues of forecasting and modeling environmental models are a vague and unclear question; there are still no clear tools, only the fantasies and theories of professors working out grants from the left-wing radical funds that we mentioned above. There is still no stochastic system, exact mathematical modeling, which with accuracy was able to at least describe and determine the motion of air masses in the planet’s atmosphere. In this matter, so complicated differential equations are obtained that to describe the climate of an entire planet with binary code is a still difficult task.

But there are still a bunch of components: streams of solar radiation differentiated in time and space, small and large cycles of solar activity (11-year-olds, 22-year-olds, as well as 80–90-year-olds (Gleisberg), ocean currents (surface and deep-sea), salinity of ocean, continental drift, changing albedo of the planet’s surface, the precession of the Earth’s rotation axis and … rotation of the rotation ellipse of the same Earth. There are also volcanoes, decaying organics, faults in the earth’s crust, the climate history of the planet, where a hundred years of meteorological observations a roaring moment and global shifts took place without the participation of any civilization. Do green activists, leftists, and Greta know that such a loudly promoted model of “climate change” is just a model (among many others!), and not reality. Moreover, not yet universally recognized? Our Transnational players quickly realized that climate agreements are a very effective tool for influencing investments in developing countries, this is a way to regulate industry in other countries from the outside, and finally, it is a gigantic speculative market where you can trade harmful emissions quotas, insurance speculative risks and a full range of related financial instruments. And Greta’s place here is to raise interest and bet on speculations and quotas around these climate agreements. Business is just business and nothing more.

Greta is also used by environmental extremists seeking to establish their dictatorship. It seems like a fantasy? Well look, do not oversleep. Greta is being exploited, it is in its purest form a political forbidden device — using children to achieve political goals, although ecology is not politics today?

This is undoubtedly a crime — when a child is used for such purposes, and autist. They are all essentially criminals who do this (parents, mentors, politicians, the press). They are the same criminals as those who armed the children and sent them to fight and kill. They mutilate Greta and deprive or have already deprived her childhood. They try to speculate on the feelings of primitive infantile, but very naive adults, and there are many of such people, unfortunately not able to analyze. There are no lofty goals for which you can sacrifice children; this also applies to the environment. They disfigured life of unhappy Greta. In addition, this is not because “the world has gone mad”, but because in the pursuit of political profits people have lost the last vestiges of conscience. Children have always been a favorite subject of political advertising and manipulations. The voter loves children — this is a win-win option for campaigning and stimulating political processes and changes in the social lifestyle.

So gradually, voters around the world will be prepared for certain environmental restrictions that have not yet been proven (as we discussed above) whether they can positively affect the climate, the economy, and society. The history of the planet knows many proven examples of both climate warming and cooling. After all, all these processes are cyclical and depend not only on human activity on the planet, but also on factors of cosmic significance. We are now in the phase of global warming, so when the phase of global cooling sets in, I am sure that the liberal greens, or who else will be there, will find another Greta who will yell about the need for global warming. History repeating! It is not ethical to use children, and it is not pleasant to look at Greta’s tantrum. Remember, the baby falling out of the window created an atmosphere of horror in Lars von Trier’s ‘’Antichrist’’. A win-win move. That appeals to our subconscious. Greta does the same with the subconscious of the majority. Moreover, this is another ethical violation. No matter what such a child saying. It does not matter if the society accused by Greta is sick or Greta fell ill, unable to cope with the pressure of this sick society. What matters is what exactly she advertises, and how we will perceive it. This works equally well in advertising for yogurts, diapers and politicians, as well as, as it turned out, in the issue of pressure on world governments and manipulating public consciousness.

Greta will not solve the problems of ecology, they will remain!

Problems will remain, and after a scorched field such as Greta and the radical left, there will be even more problems. Today it is difficult to overestimate the importance and role of ecology both in the life of the whole society and separately in the life of every person. So the state of the planet depends both on commercial companies that produce tons of waste every year, and on an individual who enjoys the benefits of civilization. It is a fact. Throughout the entire well-known history, humanity has developed and with its concepts of the world around have developed. Very early, people realized that natural gifts needed to be used wisely, without destroying the natural balance between man and the planet. Ecology is interpreted as a science that studies the interaction of living organisms with each other, as well as with the environment and the influence of the anthropogenic factor on it. In order to regulate environmental changes, scientists have identified the main tasks that ecology must solve: the development of the laws of the rational use of natural resources, based on the general principles of life organization, as well as the timely resolution of environmental problems. For this, environmental scientists identified four basic laws:

1. Everything is connected with everything;

2. Nothing disappears into nowhere;

3. Nature knows best;

4. Nothing is given just like that.

The sharp increase in consumer lifestyle has led to the unreasonable use of natural resources. The rapid development of scientific and technological progress, the large-scale growth of human agricultural activity — all this exacerbated the negative impact on nature, which could lead to a serious disruption of the environmental situation on the whole planet. There are a number of problems that need to be addressed not by the hysteria of Greta and the greens, or by the quotas of the Paris or Kyoto agreements, but by specific steps and technologies that can correct the situation experimentally. What should be resolved first?

The gene pool is rapidly deteriorating. For several centuries, the number of plant and animal species has been inexorably decreasing with great speed. We have already lost about nine hundred thousand species, and this figure continues to grow.

Deforestation. The destruction of forests occurs throughout the planet and even affects parks and protected areas, which are the main supplier of oxygen on the planet.

Air pollution has not spared a single country. Everywhere there are industrial enterprises, harmful emissions of air poisoning, exhaust fumes from vehicles.

Water pollution. Industrial waste also damages rivers, lakes and other bodies of water. In many parts of the world, water is not suitable for drinking.

The depletion of minerals. It is no secret that over the past decades, the number of minerals has almost halved. This threatens to destroy all resources and the extinction of energy sources.

The destruction of the ozone layer. About 30 kilometers from Earth is a thin ozone layer that absorbs ultraviolet rays. This gives us protection against many skin diseases, including oncology. There were years when scientists, as it were, could record its maximum exhaustion. Today, however, the press says little about it.

In fact, all aspects of the problems are affected by the anthropogenic factor. The state of air, water, land, and climate depends on this factor. The main thing is not focusing on the list of problems, but the very understanding of the causes of their occurrence, as well as concentration on effective ways and methods of solving them. The list of problems, in principle, is much wider than Greta Thunberg’s scandal about it. Climate agreements advertised by her do not cover the entire list of issues. The list of environmental problems concerns absolutely everyone that we all deal with every day, every second of our lives; without which life, as it is now, could not exist. Today, many international organizations advocate for the prevention of environmental pollution and aimed at solving many problems. There are many solutions, but it must be understood that, within a narrow framework, these methods do not work. Environmental issues need to be addressed by the entire community throughout the world. People should be involved in solving problems, but not a show, business or terrorist attack on the psyche and brains of people should be made out of solving problems.

Join the chat — https://t.me/joinchat/AAAAAE84vCXg5PK-VpHADg

Sergiy Golubyev (Сергей Голубев)

Crynet marketing Solutions, EU structural funds, ICO/STO/IEO projects, NGO & investment projects, project management, comprehensive support for business