XRP vs BTC & ETH for payments

by Ken Carabello for JetPay.cloud

Anybody who follows XRP and crypto in general, knows that the Ripple token is hugely undervalued. It's so obvious, it almost seems as if there's a concerted effort underway to keep the price of XRP depressed for as long as possible. Probably so the group of people behind this concerted effort can stock up on as much XRP as they can before the price explodes. When you compare the performance specifications of XRP to Bitcoin (BTC) and Ethereum (ETH), there is no disputing the fact that XRP is the only coin that makes sense as a vehicle for online payments.

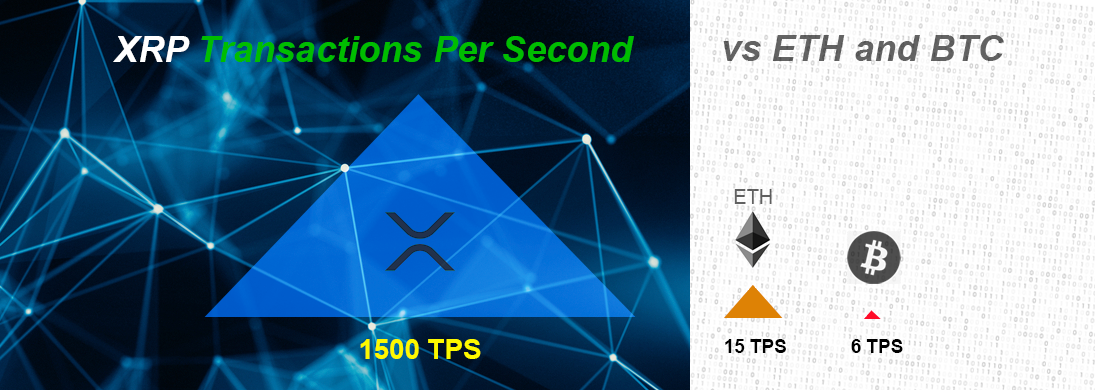

Let's look at 3 key factors – Transactions Per Second (TPS), Transaction Cost, and Settlement Speed. Upon evaluating these criteria, we'll be able to see how each coin measures up. And you will be able to decide for yourself, which coin has the most value in the area of Global payments.

Transactions Per Second – XRP handles 1500 TPS out of the box. And according to Brad Garlinghouse, CEO of Ripple, XRP is scaleable to 50,000 TPS. Compare that with BTC (15 TPS), and ETH (6 TPS). Is there any question why more and more banks are signing on with Ripplenet (#runsonxrp) as the platform of choice to move institutional-sized sums of money around the world?!

Transaction Cost - Compared side by side, if a given transaction costs $10 to perform with BTC, and $4 to perform with ETH, that same transaction would probably cost around $0.25 using XRP.

As you can see, when it comes to sending money, XRP offers a huge cost savings advantage over Bitcoin and Ethereum. XRP was designed with payments of all sizes in mind. BTC and ETH were not. And while each coin may be ideal for a distinct purpose, XRP is clearly the choice, where large-scale and/or frequent banking transactions are concerned. Banks know that at this point. As a result, one by one, they are falling in line to utilize #ripplenet.

Settlement Speed - On average, a BTC transaction can take up to an hour (or longer) to settle. ETH transactions typically take 5 minutes on average. Compare these figures with XRP's average settlement speed of 4 seconds. And again the choice is obvious. Time is money. It's as simple as that.

Bitcoin has its purpose; perhaps to remain as the “digital gold” store of value (at least for a time). And Ethereum gave the crypto community smart contracts. This was a game changer for sure. All three of these coins have value. The irony however, is that although XRP is the standout performer of the three, in what is probably the most significant area concerning the Internet of Value – bank transactions, it is also the most heavily undervalued.

As an anecdote, consider the fact that when gold was banned in 1933 by Executive Order 6102, people effectively had their gold confiscated. Then in 1934, when the Establishment was content that they had sufficiently stripped the masses of gold ownership, President Franklin D. Roosevelt raised the price of gold from $20.67 to $35 simply by declaring it so (that works out to an instant ROI of 72.5%), with a wave of his magic wand! The subsequent Gold Reserve Act of 1934 is what allowed him to do this. I can't help but see a similar dynamic surrounding XRP.

There's something big going on. All the signs are there. HODL your XRP! Don't sell it. And if you don't have a Nano Ledger already, get one as soon as you can. Move your XRP off of exchanges. And wait just a little longer. You'll be glad you did. The price of XRP must rise. And soon. It's simple logic.

https://www.youtube.com/watch?v=_mchn58NOmE

#xrp #ripple #ripplenet #globalpayments #payid #crypto #mobilepayments #cryptocurrency #blockchain #IoV #zerodoubt

© 2020 payid.cloud