What is cryptocurrency and why are people talking about it?

By Critical Complex David

Cryptocurrency is a digital version of money that is used in various ways to create value and/or to fulfill a particular purpose. Currencies are secured in a cryptographic manner creating cryptocurrencies that cannot be double spent or duplicated. Most cryptocurrencies have a blockchain that monitors and verify transactions through many different methods for proof that the network is viable.

Bitcoin is the most popular cryptocurrency and it’s blockchain is a Proof of work (PoW) consensus in which an “Operator” proves to the “Verifiers” that a specific amount of computational effort has been put forth.

Crytocurrency is getting more popular by the day but many new retail investors are unsure whether this new market is a scam. To understand crypto you need to understand their use cases. Lets use the cryptocurrency “XRP” for example. Xrp is an interoperable cryptocurrency that acts as a bridge between international currencies, meaning that it can be traded for any other currency in the world. Ripple Labs created Xrp and the currencies native blockchain (XRP Ledger) in 2012. Sending money to someone on the other side of the world just got a lot faster and cheaper on both ends.

These particular cryptocurrencies are also traded on the open market or crypto exchanges such as Coinbase and Bitrue. So when traders are buying, someone else is also selling. Companies find value in these cryptocurrencies by utilizing it’s technology to increase scalability of their network. Some traders are good at reading charts and know how to quickly get in and out of a trade that can make profits with cryptocurrencies. There is always risk involved in trading so be sure to get guidance from a licensed professional before investing major capitol.

Here are some reasons why investing in cryptocurrency is so popular:

In the world of Cryptocurrencies, decentralized networks are a key component to why people trust to invest in projects with the understanding that they are truly a part of building this network. Knowing that a large of entity does not control the price of these digital assets give investors the confidence they need to start investing. Most crypto projects are decentralized and rely on decision making by community vote. When a company builds a decentralized network or blockchain, they are essentially releasing the network to the public so that anyone can use the technology.

A great example here is the Ethereum blockchain built by Vitalek Buterin. The blockchain has a built in code called the Ethereum Virtual Machine. This allow users of the Ethereum blockchain to create what is called “smart contracts.”

These contracts can be used to create a huge problem solving technology that involves a cryptocurrency as the governance tool for operating the system. The ability to create a smart contract that has a contract agreement embedded in the code will change almost every aspect of contract agreements around the world. Imagine the headache for major corporations in 'tracking supply chains or the time it takes to fill out paperwork after buying a house. This new and decentralized way of creating agreements between parties is an incredible way operate and scale any business model that involves contract agreement.

Since 2017 many major companies have been adopting crypto publicly and under the radar. Many new influencers have surfaced in the entertainment industry, including Elon Musk. In late March 2021, Elon Musk announced that Tesla will be accepting Bitcoin as payment for their product. Other companies like Square and Microstrategy have also been adopting Bitcoin over the past few years, and they seem to be very bullish. There are also rumors of the world’s largest multinational investment management corporation, BlackRock has begin to dabble in Bitcoin. Mass adoption of crypto is on the brinks while retail investors and institutions await regulations that will allow a level playing field for all good actors.

Learn about Tax Advantages of an IRA

Follow me on social media for more interesting topics on Passive Income.

Social Media:

YouTube Cinnamon Mg.Social LinkedIn Twitter Twitter 2 Facebook Instagram Reddit Cinnamon Clubhouse

I also manage a Passive Income Crypto Community where member can post and share their own ways of earning with crypto.

Passive Income Crypto Community

Critical Complex Blogs:

The Evolution of Marketing: $Ask Permission Turn Your Data into an Asset Pac Protocol Masternode Setup Guide & FAQ Strongblock Node Setup & FAQ Tax Advantages of an IRA Earning Passive Income: Celsisus Network Crypto IRA/401k with iTrust Capital Mg.Social A Crytpo Social Media Paltform New Token Live Now Fashion Accepts Bitcoin & Doge What is Cryptocurrency and why are people talking about it

Basics of Researching Crypto Projects

By Critical Complex David

These are only basic steps to researching projects. Researching is a such a speculative opinionated skill so always remember to think for yourself. These steps are originally made for a beginner who wants to research but has no idea where to start. The rabbit hole gets much deeper than these few steps. Try to stay in a direction that you feel comfortable with and understand.

Crypto may peak the interest of many new investors that find themselves wondering how to properly judge a crypto project. From my own personal experience understanding crypto projects could be comparable to understanding companies with stocks. Investors usually choose an industry they understand. To understand these cryptos you may first want to understand their blockchain and try to see if you can relate to its original purpose. Understanding blockchain technology can be a complex thing, but if you are even a little tech savvy you may find ways to simplify and comprehend what is going on. Most blockchains are decentralized. This means that it is not controlled by one central authority and when the creators finished the network they released it as open source for any one to use and build upon. When a blockchain is built upon you have created what are called tokens. Understanding the difference between a crypto token and a crypto coin is important to know when researching crypto projects.

A crypto coin is a cryptographic data block that has its own native blockchain that was designed specifically for the technology usage of that particular crypto. Bitcoin is a coin because it has it's own blockchain that uses a Proof of Work (PoW) consensus mechanism to verify the value of each individual block.

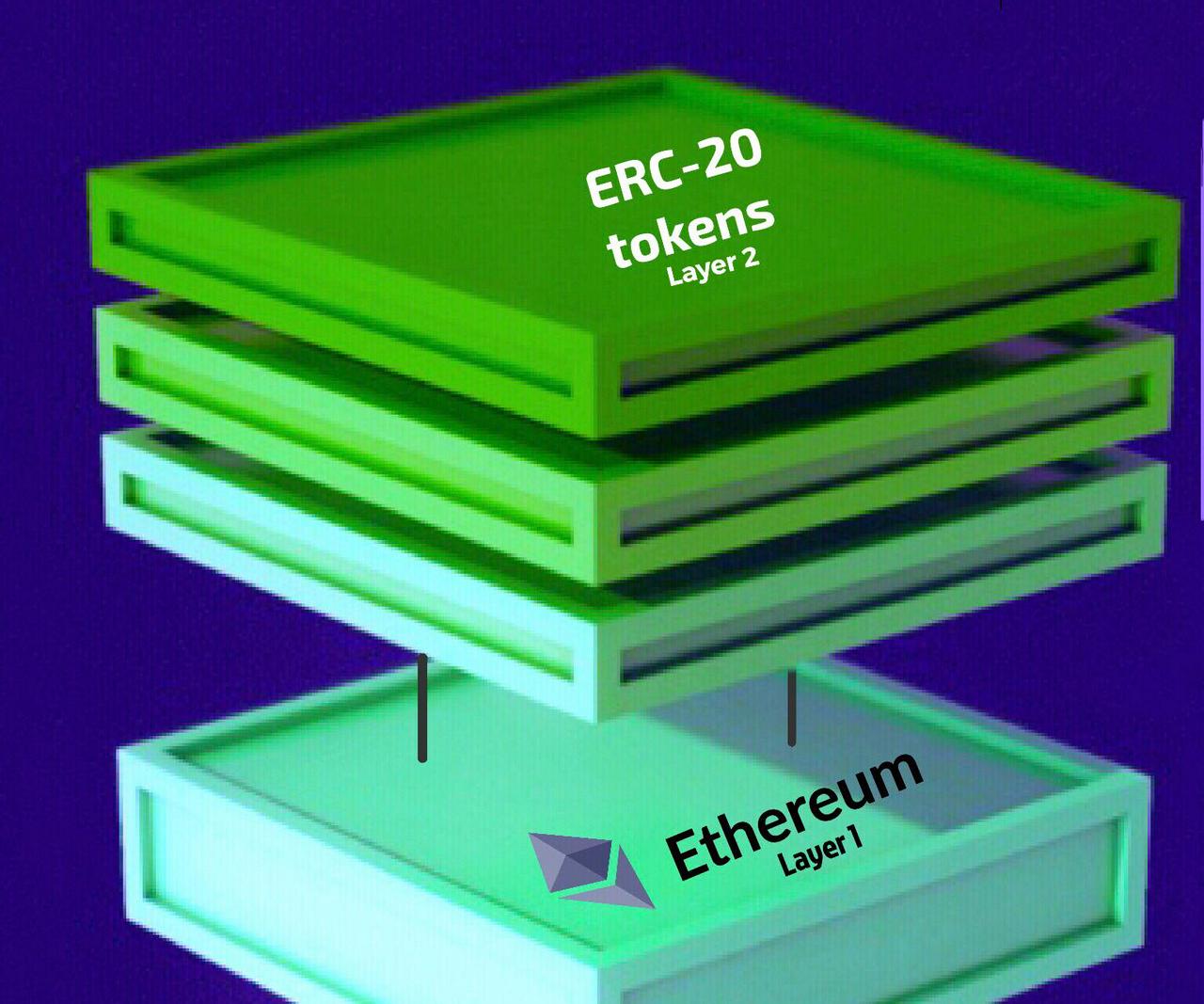

A crypto token is code designed to integrate with a specific blockchain. Ethereum blockchain is the perfect example to use in this situation. The Ethereum blockchain has built in it's code what is called the Ethereum virtual machine. This open source technology allows developers to create smart contracts, that usually results in the creation of a crypto token that is utilizing the Ethereum blockchain. Chainlink is an ERC 20 token. This means that it is coded on the Ethereum blockchain but it represents it's own token through usage of buying and selling on the market.

Using your own judgement when observing crypto projects is critical to your research. You may look at a project and think it is really cool, or you may think “Well isn't there a major project that already does this?” There are so many creative ideas surfacing on the crypto scene. New and innovative technology like Decentralized Finance and Yield Farming. Your perspective is your own and no one else can make a project more interesting than it really is. If you understand the technology of a project and how it plans to change or solve a big problem in the world today then by all means research it.

Data Resources

A great starting point for research is Coinmarketcap.com. This site is a one stop for current market data on all cryptocurrencies. Visiting coinmarketcap.com will immediately introduce you to the top 100 cryptocurrencies by market cap. This means that they are listed from the highest market value to the lowest. Bitcoin is at the number one spot with a market cap of over $600 billion at time of writing. If there is a crypto project you are interested in you can use the search bar and find it data.

A great starting point for research is Coinmarketcap.com. This site is a one stop for current market data on all cryptocurrencies. Visiting coinmarketcap.com will immediately introduce you to the top 100 cryptocurrencies by market cap. This means that they are listed from the highest market value to the lowest. Bitcoin is at the number one spot with a market cap of over $600 billion at time of writing. If there is a crypto project you are interested in you can use the search bar and find it data.

Max Supply and Circulating Supply

Some key factors to take into consideration are the maximum supply and circulating supply. The maximum supply of a crypto will give you an idea of how much this particular crypto can scale. Scalability is important for preventing one large entity from gaining majority control over these projects. Scalability can also be important for networks whos use case requires a wide range of users. The maximum supply may sometimes differ from the circulating supply. Some crypto networks are designed so that tokens are minted over time or for specific network verifications. So the circulating supply could be what is available on the market and what investors are holding, and the remaining maximum supply could be stored inside the decentralized network awaiting task to be complete in order to release new tokens to the circulating supply. Some cryptos have a low supply overall and this may sometimes result in a high demand.

Market Cap

The market cap is a representation of the overall value of all the circulating tokens combined. For example if there are 10 million tokens and the value of the token is $1, the market cap will be $10 million. Judging whether a market cap is impressive or not is up to you. Cryptos projects with a multi billion dollar market cap tend be very volatile. This means that they move up and down a very lot. It is ideal to find a project with a lower market cap that you believe has potential to grow in the future. Getting in early projects before they take off is what most crypto investors are seeking to do. It is definitely a good idea to thoroughly investigate the purpose of a project. This is where your own perspective comes into play. Do you believe this project is great technology? Is it decentralized and community driven? If these things are important to you then make a check list and find your favorite project.

Team

The number one thing I always look for is the team who created the network. Researching the team shouldn't be that hard if they are good actors. Transparency is very important when choosing to invest in a project. Most cryptos will have a direct link to the website designed to illustrate the basics of the network. Usually project websites will have an about section or a team listing. Look up the team and their history with blockchain technology and make your own conclusion on whether you think they are good leaders for this particular project. Some Founders and CEO's have no history in blockchain, but may have a impressive background in other sectors. Not everyone will have experience as a cryptographer or full stack developer. It's up to you to decide if this team is transparent and community oriented. Many founders have history with major companies in the stock market and decided to give a go at crypto projects. A good team that acts as a steward to a decentralized network that they designed is an important factor to take into consideration. Some projects have bad actors that build networks with the intentions of stealing money from investors. These bad actors usually hide their identity or try to create a fake profile of professional individuals to trick investors. That's why it is very important to make sure the people you are researching are real people. Good actors will be transparent. You will be able to find their professional profiles on Linkedin or Twitter. Check to see if these team members are active. Do they interact with the community? Do they hold public AMA's for the community to directly communicate with them? You will want to know if these actors have the community interest in mind.

Blogs and Community Channels

Most projects will have a blog on a major blog site likes Medium or Write.as. They also use Telegram and Discord as a base for the investor community to communicate directly. Joining these community channels is a great way to dig deep into the project and learn more. If you are new to cryptocurrency take extra precautions when joining these groups. Scammers like to disguise themselves as administrators of groups with large community reach. Always take extra steps to make sure you are speaking to the correct individual and never give anyone keys to your wallet. Also, never connect your wallet to a network that you do not recognize.

White Paper

Crypto projects have what is called a white paper. This is an original document drawn up by the creators explaining the purpose of the network and its native crypto. These documents are sometimes called “Litepaper.” Read over these documents to get a better idea of the structure of the decentralized network. Some white papers are subject to change unless it is stated in the official document. Community driven projects usually have voting mechanisms so whenever changes are brought to the table the community votes and decides on whether it is a good idea or not. Make sure to read the white paper and understand whether or not this is a good project for you. It is a good idea to make sure the project is legal. Make sure they have been security audited and that they have registered in the necessary manner. Some crypto companies must register as a Money Service Business which mean they fall under BSA laws. Understanding a few requirements by law may help you avid investing in a scam.

Partners

It is not necessary for every crypto project to have major partners. But having major partners is a great look for new startups. Certain partnerships in the cryptosphere trigger extreme demand for projects. There are many crypto projects with partners outside of the blockchain and crypto industry. Partnerships do not guarantee success. Try to dig deeper and see if you can find out more information on the partnership and how it benefits each network involved. Also, check on the status of their efforts towards the expansion of these partnerships. It is always a good idea to double check and make sure these partnerships are legit.

Terms of Use

This is the part that most investors ignore and want to completely avoid. Reading the Terms of a project will give you a more clear understanding of how your funds are kept safe and whether you are insured in case the project experiences a system wide hack. Always make sure to read the terms of use of each project you research. Understanding the terms is very important when investing your own hard earned money. Some crypto companies are not required to register in a manner that protects your investments. Make sure to go over the terms of use of each project you decide to get involved in and take notes to make sure you understand what risk are involved. Understanding these few things will help you from getting involved in scams. I am not your financial advisor so take this as education but this is some the best information I can give you to guide you in the right direction. Make sure to always do your own research.

These are only basic steps to researching projects. Researching is a such a speculative opinionated skill so always remember to think for yourself. These steps are originally made for a beginner who wants to research but has no idea where to start. The rabbit hole gets much deeper than these few steps. Try to stay in a direction that you feel comfortable with and understand.

How I Research Crypto Projects

Follow me on social media for more interesting topics on Passive Income.

Social Media:

YouTube Cinnamon Mg.Social LinkedIn Twitter Twitter 2 Facebook Instagram Reddit Cinnamon Clubhouse

I also manage a Passive Income Crypto Community where member can post and share their own ways of earning with crypto.

Passive Income Crypto Community

Critical Complex Blogs:

The Evolution of Marketing: $Ask Permission Turn Your Data into an Asset Pac Protocol Masternode Setup Guide & FAQ Strongblock Node Setup & FAQ Tax Advantages of an IRA Earning Passive Income: Celsisus Network Crypto IRA/401k with iTrust Capital Mg.Social A Crytpo Social Media Paltform New Token Live Now Fashion Accepts Bitcoin & Doge What is Cryptocurrency and why are people talking about it

What is Blockchain

Blockchain is a ledger of transactions that records data in blocks. The blocks are linked together in a cryptographic manner. This can be difficult to understand, but each block contains a hash of the previous block with all of the transactions data inside. The blocks eventually looks for a chain with each block before it reassuring the previous hash was valid.

The first blockchain was created in 2008 by pseudonymous Author Satoshi Nakamoto. After improving the design it was later implemented as a key component of the cryptocurrency Bitcoin.

Blockchains are decentralized which means they are not controlled by one single authority.

Storing data

Storing data across a peer-to-peer network eliminates a lot of risk involved with using a centralized platform. Every node in decentralized system has a copy of the blockchain. Blockchains use schemes such as proof-of-work to expose changes.

Permissionless blockchains

Permissionless blockchains are open have no access control and are open to the public for use. This mean that developers can use the network to build without the approval of the creators. A public blockchain provides data to anyone who wants to observe the chain. Blockchain technology can be used in many ways. The most common use for blockchains are a public and distributed ledger. To break it down, a blockchain is the public record that is used to track and verify transaction done on the network. Different consensus mechanisms are put in place to avoid double spending or duplicating on the network.