Let's talk “Rippling” – Part I

Ripplepay, the brainchild of Ryan Fugger in 2004 which helped form the XRP Ledger we know today, relied on a concept Ryan called “Rippling”. It was the namesake of his project and for good reason.

For context: As a kid, you may have been promised £10 for house chores but you couldn't go to the shop and spend that money before receiving it. You had to wait, until you were given it. The same is true today, you can't just wander down to the grocery store, with a debit card in hand and spend money that isn't in your account.

[Below, the Ripplepay logo]

Ripplepay was different. It relied on a network of trusted friends and businesses; you didn't have to trust everyone in the network, you only had to trust the person you were exchanging with.

“Rippling” occurs when more than a single 'trust-line' in a network is adjusted to make a payment. This can be confusing so I shall attempt to explain “Rippling” with a short story:-

Let's say you're a joiner, your name is Bob and you've offered to hang your neighbour's new kitchen door. Alice, your neighbour doesn't have cash to hand but you're very confident that she will pay eventually – After all your wife has a fiery temper when it comes to money.

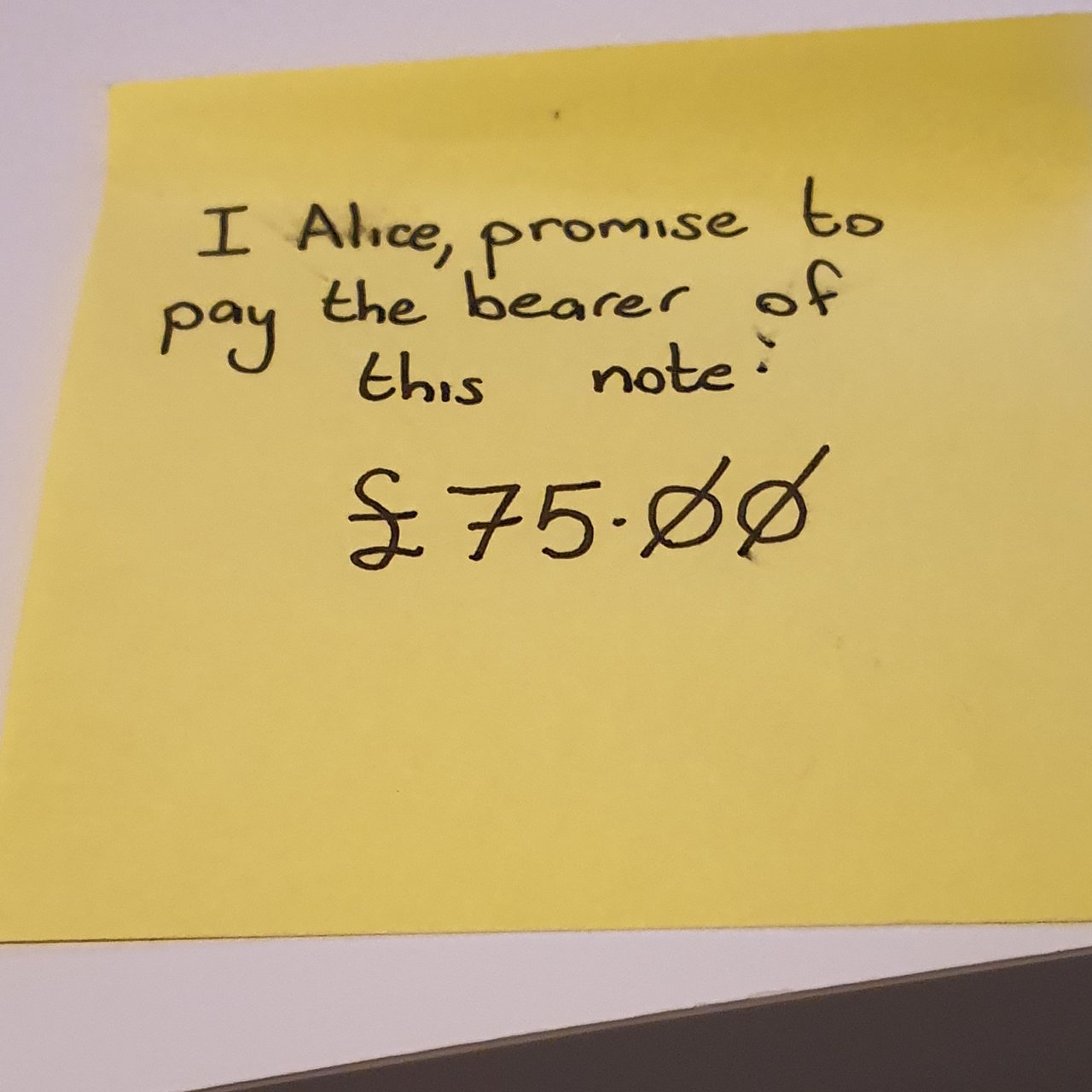

Alice promises to pay you £75 for your hard work and even offers you a post-it note, *"I Alice, promise to pay the bearer of this note: £75.00"*. You leave but remember the grocery store.

- At this point Alice owes you, Bob, £75 for your labour.

You arrive at the store with a hand scribbled note, a £75 IOU, you've collected your groceries before arriving at the check-out counter. The shopkeeper scans your items and requests £30... Bother... You only have that note from Alice?

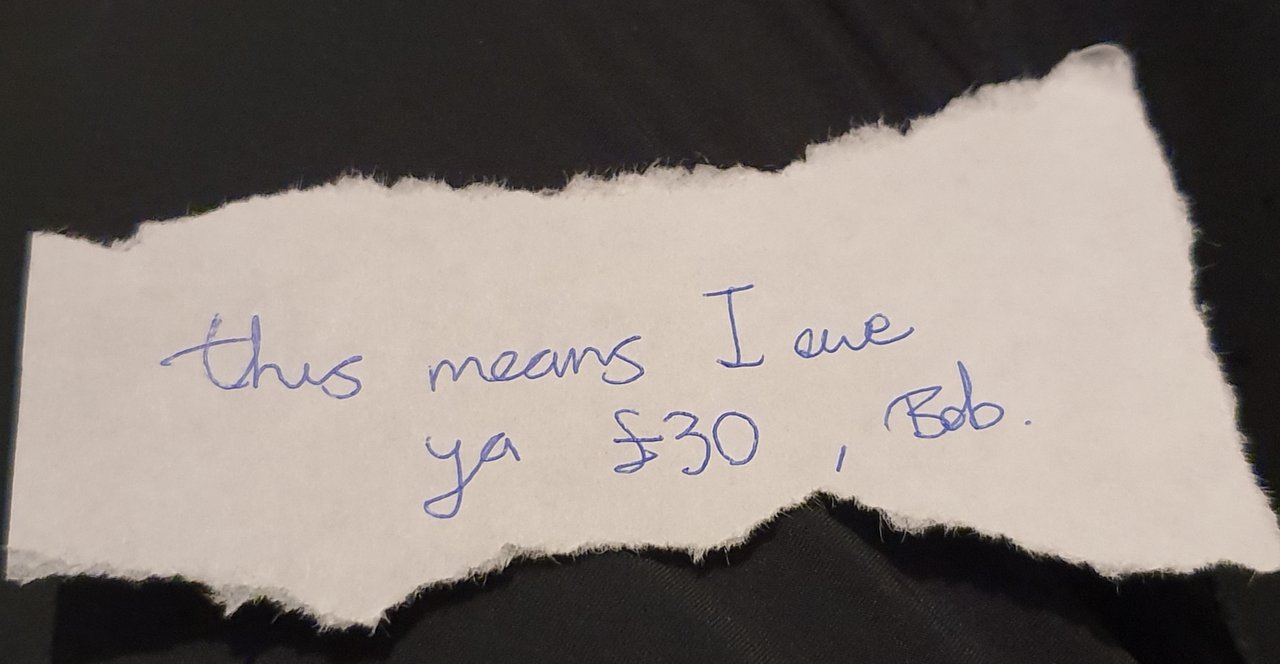

You ask for a pen and paper, the shopkeeper produces some torn-up scrap from under his counter and you scribble down “*This means I owe you £30"*. It's a good thing this is a small town. You know Daniel the shopkeeper rather well as you both have a fondness for drinking real ale.

- At this point Alice owes you, Bob £75 for your labour...

- and you just promised the shopkeeper, Daniel £30 of that.

We now find you at home with your wife and daughter Charlie, who would quite like her pocket money. She too wants to visit the store before it's dark. You have no cash as Alice only gave you a post-it, so this time you hand-write another for £10.

At this point Alice owes you, Bob, £75 for your labour...

just earlier you promised the shopkeeper, Daniel £30 of that.

You now also have a note Charlie is carrying, for £10.

Daniel is busy tidying the shopfront when Charlie arrives at the store. He sets aside his broom and waits by the counter... Soon after Charlie reappears with sweets which Daniel buzzes promptly through.

“That will be ten pounds then, please.” Daniel postures.

Rather awkwardly, Charlie presents a slip of paper with your writing scrawled across it.

“Hmm,” Daniel grumbles, “Your Bob's little-girl then? You'd best tell 'im he owes me forty quid!”

At this point Alice still owes you, Bob, £75 for your labour...

and earlier you promised the shopkeeper, Daniel £30 of that.

Charlie was carrying a handwritten “IOU” for £10...

... but then again, she used that at the store...

... so you figure Daniel will be wanting that too.

When you began the day working at Alice's you hadn't planned on all this. Daniel expects you to pay up, he doesn't know you're relying on Alice, he just knows you're good for the money... Usually.

- Now that last bit is important, Daniel didn't have to know Alice who was the original IOU scribbler, indeed he didn't really have to know Charlie either. He knew you well enough. Alice's IOU has “rippled” through this pool of people.

Once Alice gives you that £75 tomorrow, you'll only have thirty-five left as £40 is rightfully Daniel's. Unfortunately the next day you are far too busy to see your neighbour, but by happenstance you do greet Daniel.

Daniel requests his money and to his bewilderment you say,

“My neighbour Alice owes me seventy-five quid, if you knock at the door with those notes in hand, I'm sure she'll give you the money...”

With your phone in hand, you call ahead and Alice says there is £75 waiting for you.

“Well...” you start, “I didn't have any cash so I wrote a few notes too and as it happens, I've sent the shopkeeper your way...”

So from this story I hope we learnt that “Rippling” is the ability to ask Alice to use some of the money she owes Bob, to pay Daniel; it is the ability to not only promise somebody payment but to instead actually pay them with an IOU for goods/services. This relies on the trust that when the time comes to collect what is owed, the issuer is good for it.

In smaller communities this IOU ideology works quite well & is successfully used throughout the developing world. With the advent of the Ripple Consensus Protocol in 2011, Ryan Fugger's original vision has morphed somewhat. Perhaps due to a less user-friendly interface at the time, it didn't catch on as well we hoped.

XRP is the ledger's native asset and can be exchanged for any IOU utilising the built-in decentralised exchange, it typically garners the most attention. Not surprising as it has no counter-party risk & cannot be “frozen” in any way.

In part ii, I hope to explain how developers shall utilise Rippling in their consumer-ready apps to allow ease of payment and other related topics.

[For Coil subscribers, below I go into some aspects of Rippling today on the XRP Ledger and what its drawbacks are.]

Continue reading with a Coil membership.