Five Golden Rules to Follow When Taking a Loan

Taking an instant personal loan to meet immediate cash requirements has become extremely important. When there is a need for an instant loan or extra funds, the borrower searches for viable, secure, and reliable options. The promise of offering hassle-free procedures and easy step-by-step procedures helps offer the borrowers peace of mind. With the technological advancement in the financial sector, the loan approval and disbursal process have become extremely easy. The loan app has gained the utmost importance today because of the facility it offers to borrowers. They value not only the time of the borrowers but also understand the financial obligations. Before applying for a loan, you must consider the following rules:

Borrow According to the PayBack Capacity

The borrower must consider their payback capacity before applying for a loan. Considering the payback amount before applying helps the borrower quickly pay off their loan in a good way. The borrower must avail of a loan if they need cash. Many financial institutions provide loans with many offers to attract new customers, but the borrowers should not fall for these options restlessly. Remember that don't just borrow to claim tax benefits or just because interest rates are low.

Opt for a Short Repayment Tenure

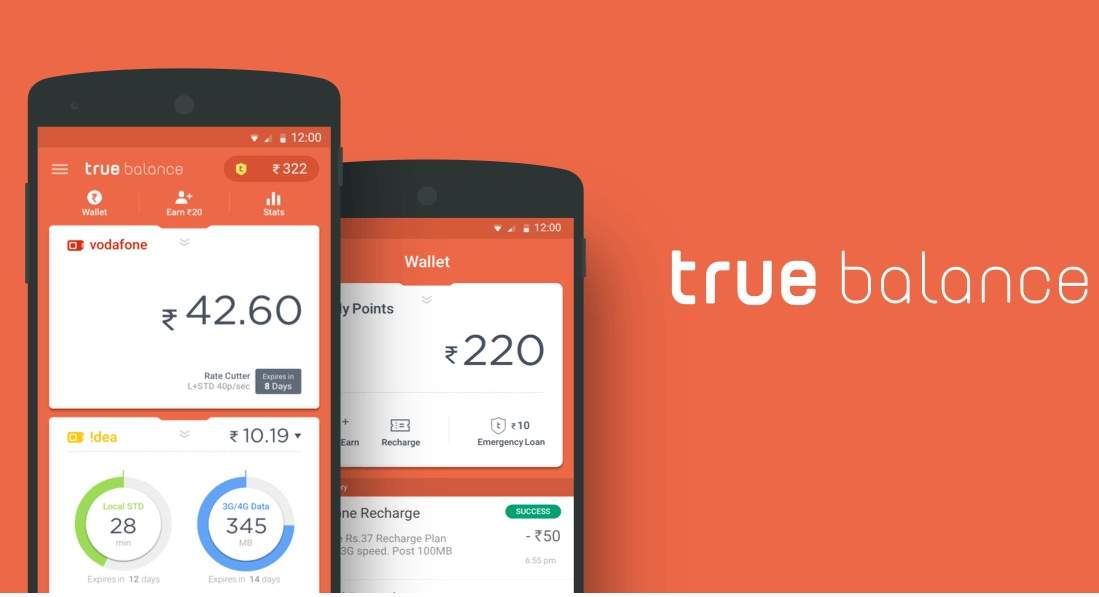

After deciding the loan amount, the next thing that the borrower must look for is the repayment period. Many lenders offer loans up to a maximum limit of 30 years because the longer the repayment cycle, the lower the EMI will be. This might sound attractive while borrowing, but the interest rate for an extended period may increase the borrower's amount to pay back. It's the responsibility of the borrower that they may look out and switch to the lenders that offer loans at a low personal loan interest rate. True Balance offers best-in-class services and low personal loan interest rates to the borrower at the time of emergency.

Ascertain Regular and Timely Payments

It's better to prioritize your expenditure beforehand and let the payment dues be your first priority. The more timely and regularly you are paying back your loan or EMI, the better your chances of paying back the loan amount and earning a good credit score for future benefits. Delaying an EMI involves paying back hefty penalties and added interest. To avail of credit in the future, this may be a problem in future.

Take a Life Cover with Big Ticket Loans

Applying for an insurance cover while applying for a loan is one of the wisest decisions. It helps to ensure that your family can easily bear the loan amount under various circumstances where something unfortunate can happen to you. It helps to protect your family and even helps to save those assets which have been mortgaged for applying for the loan. It is also important that the borrowers must read all the terms and conditions of the loan.

Opt for Affordable Loans

As a borrower, it's your responsibility never to borrow an amount that is more than your capability of paying. Your EMI's should be quickly paid back without any hassle and should be manageable. Make sure that your repayment amount must not exceed your monthly net income.

There are various instant loan apps available in India that offer loans to borrowers at easy terms. For personal loans online, apply via the True Balance app, as it is one of the best apps known for the secure and reliable service it provides. It offers the borrower a loan of up to INR 50,000 without any collateral backup in return. Also, you do not have to worry about interest rates or processing fees as it is very low. It aims at offering services to lots of people without any hassle. For an instant loan, apply via the True Balance app without any delay!