A Centralized Business Model: Riding Coattails to Success

A Centralized Business Model: Riding Coattails to Success

Centralized vs. Decentralized business model: Which Is The best Model For Startups?

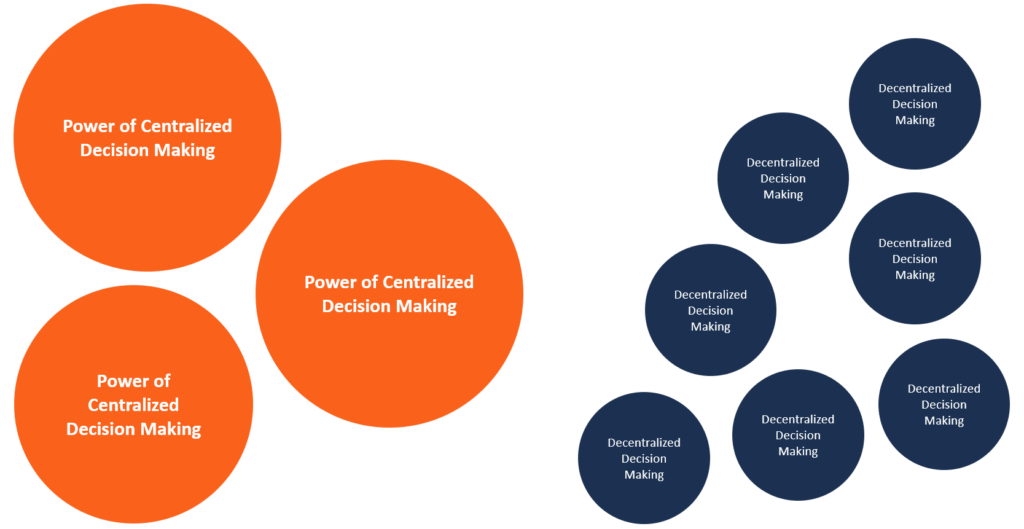

Centralized and decentralized are the two most popular organization structures, deployed by businesses around the world. Size and diversity, as well as goals, determine a great deal, the operational structure that most businesses end up deploying.

Understanding centralized business model

A centralized business model is common in areas where control is important. The model finds excellent use in areas where management or owners want to maintain full control of what happens behind the scene in an attempt to attain set out goals. Operational decisions with centralized organization structure are made at the top, with little or no authority delegated to lower levels of operation.

Likewise, entities deploying centralized business model lock up all profits or revenues generated from underlying operations. In this case, there is no distribution of profits or returns with other people or entities involved in the core business.

Centralized business model are synonymous with financial institutions whereby top managers are tasked with the responsibility of making key decisions and plotting a business course as well as operations. Lower-ranking staffs are only tasked with the responsibility of implementing whatever higher-ranking officials decide.

Similarly, any profits or returns generated are rarely shared with other people. In this case, the profits are retained and used in business expansion or the unveiling of new products. Conversely, profits are never shared with customers who might have played a pivotal role in ensuring a firm attained its financial goals.

Understanding Decentralized Business Model

A decentralized business model is synonymous with large institutions or companies whereby responsibilities, as well as decision making, are delegated. In this case, there is no central point tasked with the responsibility of making decisions.

Instead, a management team approach is applied. High levels of delegation with decentralized business structure see several individuals tasked with the responsibility of running the business and making crucial decisions.

Likewise, a decentralized business model is synonymous with diversified product mix. Returns generated are many at times shared with various entities or individuals, which make up part of the broader business structure.

YouTube, as well as e-commerce platforms Amazon and eBay, are a perfect example of entities that have perfected the art of decentralized business structures. All the revenues generated by the respective entities are many at times, shared between various parties.

YouTube shares a significant amount of ads revenues generated with content creators. By running adverts on individual accounts, Google ends up paying account owners a portion of the revenue it generates on running adverts on their accounts.

Amazon and eBay also rely on the decentralized business model to generate a significant chunk of their overall earnings. By providing a platform through which merchants sell items, the two platforms are entitled to a portion of profits that the merchants make on each product sold. Instead of merchants on Amazon or eBay ending up with all the revenues, they share accordingly as per the agreed terms.

Centralized vs. Decentralized Business Model: Startups Case Study

Startups are usually in the early stages of growth, where control is crucial if a business is to remain on course on a set-out vision. Conversely, centralized business model acts as an ideal operational structure for startups looking to make it in highly competitive industries.

Centralized business model allows startup owners to develop missions and visions as well as set objectives that managers and employees must follow. Having control of decision making ensures everything is done towards a focused vision.

The centralized business model allows startups to adhere to standard procedures and methods. Conversely, the organizational structure leads to a reduction in office and administrative costs. Given the small nature of the business or operations, decision-makers are housed in one location as there is no need to deploy more departments.

With centralized business structure, startups don’t need to spend much on office space or administrative expenses as everything is done from a centralized location. The structure also does away with the need to hire experts or experienced personnel at each level, as is the case with decentralized business models.

A clear chain of command reduces duplication of responsibilities that can trigger additional costs. Likewise, management maintains a better command overall subordinates as there is no duplication of duties or operations.

A centralized business model also allows startups to retain a good chunk of all the profits generated instead of sharing it with other entities or parties. Just is the case with banks and other financial institutions, startups deploying the centralized business structure maintain full control of the profits, which are, in return, used to accelerate growth through expansion and unveiling of new products or services.

Control and accountability are other synergies that startups deploying the centralized operational structure tend to enjoy. The fact that leaders are in charge of all major decisions ensure they retain control over all operations and development of underlying culture. Accountability, in this case, is usually of the highest order, thus ensuring every person operates at peak level.

Consistency is another key strength that centralized startups tend to depict. The fact that decisions are made by the same person or a group of leaders ensures they are made in a consistent and predictable manner. Consistency helps workers know what they can expect, thus averting frustrations that can emanate as a result of inconsistencies in changing decision patterns.

Centralized business model also tends to lead to higher levels of innovation as management clearly define the organization vision. In this case, employees focus their talent and energy to a given goal, which leads to improvements in work quality. Standardization of process enhances innovation while reducing wastage

The operational structure enhances innovation as everybody works towards a common goal. Similarly, it enhances better capital management by reducing costs of operation by averting redundancy. Quick implementation of decisions, as well as, improved quality of work are other synergies that startups tend to leverage with a centralized business model. Centralization is an ideal operational structure for startups, given the definitive advantages, it comes with.

Coil subscribers find out why this matters to you...