I don't normally do this, but @SethStanley asked me to make a quick introduction to CubDefi.com. So here goes!

(this post is NOT financial advice)

What is CubDefi.com?

Cubdefi.com is a swapping platform that was developed by a group of finance enthusiasts at Leofinance.io. LeoFinance in turn is a blogging platform that runs on the Hive blockchain.

At the moment you can swap tokens such as BTC, BNB, BUSD for Hive related tokens such as DEC and LEO. But the more lucrative bit is where users can store tokens in liquidity pools. These liquidity pools help to stabilise the token prices, and in return the contributors to these pools receive compensation in the form of so-called CUB tokens.

CUB tokens go for $3-$4 each at the moment, and can be sold near-instantly for a ~$0.40 fee using the same platform.

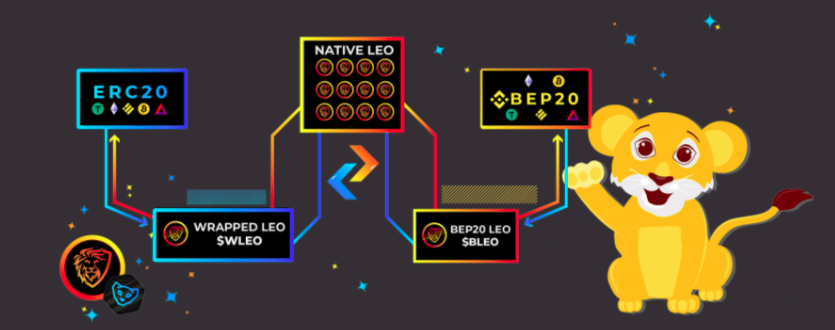

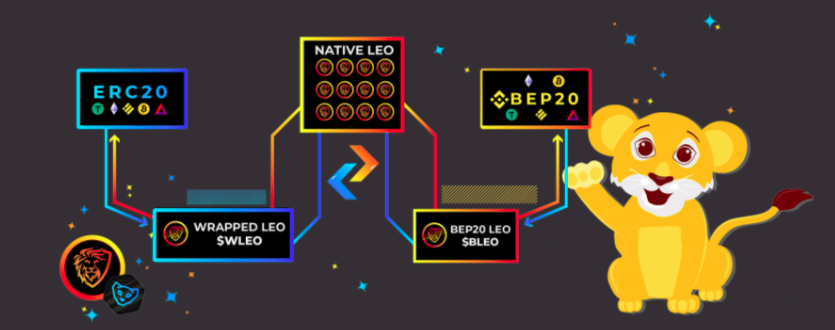

Design sketch of the LeoBridge, a way to convert ERC20 (Ethereum) to BEP20 (Binance Smart Chain) tokens. Image courtesy of LeoFinance.

In a few weeks they will establish a bridge that allows people to swap Ethereum-wrapped tokens for tokens that are wrapped on the Binance Smart Chain, and that bridge is likely to give much more user uptake.

What do you need to use it?

It's not completely trivial, but also not terribly hard: you need to have a Metamask crypto wallet (or the Brave Browser wallet), and you need to do about 2 minutes of work to add support for the Binance Smart Chain.

You then need to move tokens (I normally use BUSD) into the wallet. The easiest and cheapest way (no fees) to do this is by moving tokens to Binance, converting them to BUSD and then withdrawing BUSD to your Wallet address.

Once you've done that, you can then convert the BUSD to whatever tokens you want using the platforms, use pairs of tokens to contribute to liquidity pools or (some of the) individual tokens to contribute to so-called dens, which serve as a staking storage.

How do people earn from this?

Rewards on CubDefi.com are paid out in CUB Tokens. One new token is generated per BSC block, so the inflation rate is reasonably large but gradually decreasing over time. The developers of CubDefi participate in the pool, and they tend to hold quite a fair amount of LEO and CUB tokens themselves as a result of that.

What makes CubDefi quite unique is that the developers and infrastructure providers do NOT take a cut on the fees! Instead, 80% of the deposit fees (typically 2%) are used to purchase and burn CUB tokens, and 20% of the deposit fees are used to purchase and burn LEO tokens.

By burning tokens, the value of the remaining tokens increases due to scarcity. This is then intended to give all participants, including the developers, a likely growth of their portfolios in value.

I think the design is quite elegant, because both the users and the developers have the same incentives to make the whole system work.

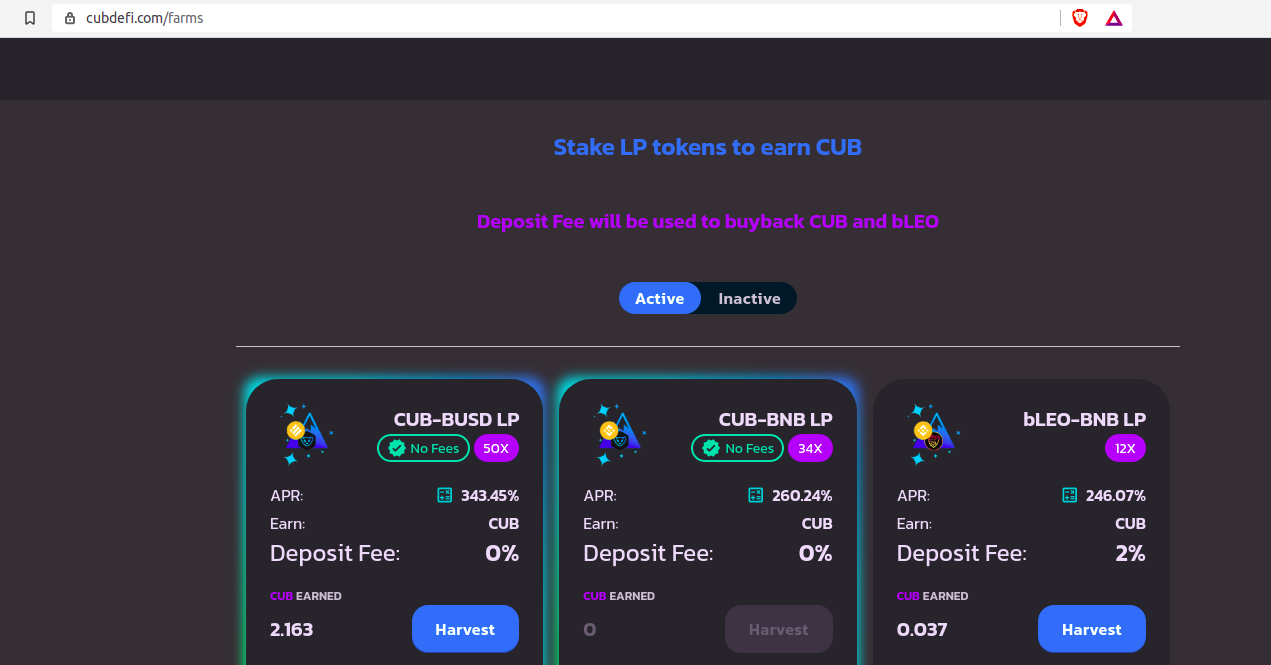

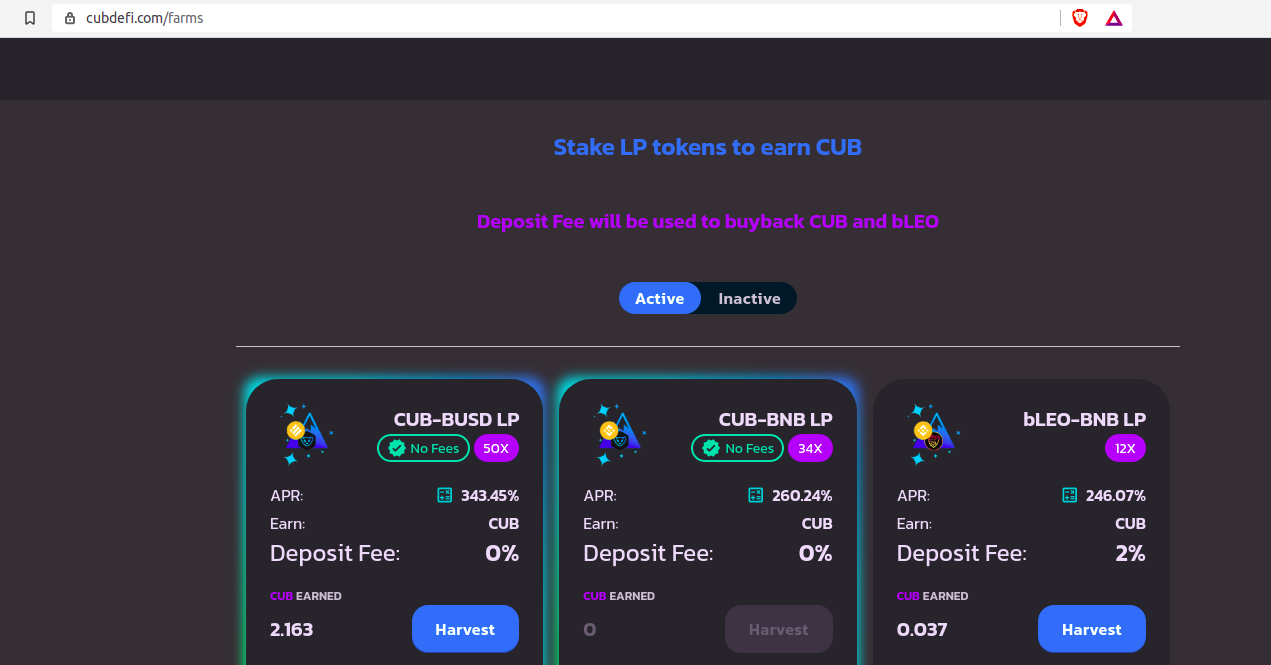

A sample of the APRs from a few liquidity pools, as of 19-04-2021.

Typical earnings are +100 to +350% per year for liquidity pools (if token prices stay constant), and +30% to +150% per year for the staking “dens” (if token prices stay constant). If you compound your earnings, the rates can in theory become much higher than that.

Those APRs are of course great when you compare it to a normal savings account, but (a) they are likely to drop when the platform grows, and (b) a DeFi platform is a good bit riskier than a normal savings account!

What are the main risks then?

I'm sure there are many risks I haven't thought of, but here are four main risks that I have been able to figure out:

1. Any decentralised finance platform has the risk of the so-called rug pull, where the developers steal the tokens and close up shop. CubDefi has been through a CertiK audit procedure to help protect from this, but even audited platforms do sometimes end up being rug-pulled.

2. When you invest in a liquidity pool of, say CUB and BNB tokens, it is well possible that the value of your investment will grow less fast than if you were to hold only CUB or only BNB tokens. This is called impermanent loss, and is explained in more detail here.

3. Platforms can get hacked, and as mentioned before this actually happened to the LeoFinance community before. In my opinion, the way they handled that initial hack (and how they most likely learned from it) is a useful risk mitigator here.

4. There is little regulation around crypto platforms and especially decentralised finance at the moment. When that changes these platforms may become much less easy or favourable to use. But only time will tell.

How did I discover it?

I became familiar with Hive through Splinterlands, then discovered Leofinance as part of Hive. I was apprehensive of the Leofinance activities at first, since it was such a nascent community. And indeed, they had a liquidity pool on Uniswap that did get hacked last year. But what won me over was the way they dealt with the hack: rather than cutting losses, the developers went out of their way to compensate the victims, even if that meant incurring serious losses themselves. Ever since I've become an increasingly active participant in the Leofinance community.

Closing thoughts

Well, this is mainly a primer on behalf of Seth Stanley's request, but I hope it was useful for you as well!

One last thing I want to mention is that there are many other swap sites on the Binance Smart Chain. I've heard of GooseSwap, PancakeSwap, SushiSwap just to name a few. However, I have no clue about the background and reputation of those platforms, so I am extremely hesitant to use those platforms for anything other than swapping a few tokens. But perhaps some of you have different views?

If you have any thoughts or comments, feel free to drop me a line on Twitter or Mg.social (@whydoitweet) :).

An introduction to CubDefi.com

An introduction to CubDefi.com